Congratulations on your desire to achieve financial independence from the comfort of your own home. In today’s digital age, there are numerous opportunities for you to build a successful career and generate a substantial income without ever having to step foot in an office. However, it’s important to be aware of the challenges and pitfalls that come with working remotely, as well as the key strategies that will help you achieve your goals. In this blog post, we will explore the most effective methods for attaining financial independence from your home office, allowing you to take control of your career and your financial future.

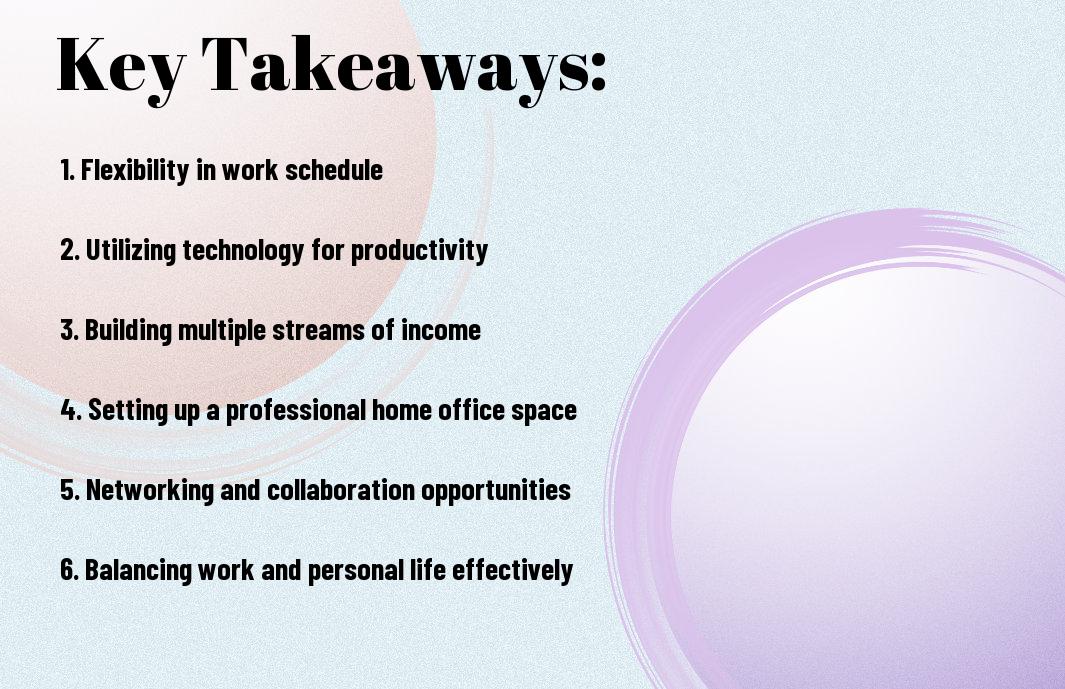

Key Takeaways:

- Managing Time Effectively: Remote workers must prioritize time management to increase productivity and achieve financial independence. Utilizing tools such as time-tracking apps and setting structured work hours can help in better managing time.

- Developing Multiple Streams of Income: Diversifying income sources is crucial for achieving financial independence while working from home. Generating passive income through investments, freelancing, or creating digital products can provide stability and long-term financial security.

- Building a Strong Online Presence: Establishing a strong online presence through social media, marketing, and networking is essential for remote workers to attract clients, customers, and opportunities for financial growth. Creating a personal brand and engaging with online communities can lead to greater financial success.

Establishing a Home Office

Any successful remote worker knows that the key to productivity and success is having a well-equipped home office. Whether you are freelancing, telecommuting, or starting your own online business, it is essential to create a dedicated workspace within your home. Your home office should be a place where you can focus, collaborate, and ultimately, achieve financial independence. Here are some strategies to help you establish a productive home office.

Choosing the Right Space

When selecting a space for your home office, consider a few key factors. You want to choose a location that is quiet, well-lit, and free from distractions. It should be a separate room if possible, to create a clear boundary between your work and personal life. Make sure the space has enough room for your workstation and any necessary supplies. Additionally, consider the potential for natural light and ventilation to create a comfortable and productive environment.

Essential Tools for Remote Work

Equipping your home office with the right tools is essential to maintaining productivity and efficiency. Invest in a reliable computer or laptop, as well as a high-speed internet connection to ensure seamless communication and collaboration. Consider ergonomic office furniture, such as a comfortable chair and desk, to support your posture and minimize physical strain. You may also need to invest in software and apps that facilitate remote work, such as project management tools, communication platforms, and productivity apps. Having the right tools at your disposal will enable you to stay organized and focused on your work.

Investing Strategically for Remote Work Success

However, achieving financial independence while working remotely requires more than just a steady paycheck. It also involves making strategic investments that can grow your wealth and secure your future. Whether you’re a freelancer, entrepreneur, or remote employee, understanding different investment strategies and choosing the right investments that align with your remote work lifestyle is crucial for long-term success.

Understanding Different Investment Strategies

When it comes to investing, you have a variety of strategies to choose from, each with its own potential risks and rewards. From stocks and bonds to real estate and retirement accounts, it’s important to understand the different options available to you. Diversification is key to spreading your risk and maximizing potential returns. You may consider exploring low-cost index funds, ETFs, or target-date funds for a well-diversified portfolio. Your risk tolerance, time horizon, and financial goals should all play a role in determining which investment strategy is best for you.

Choosing Investments that Align with Remote Work

As a remote worker, you have the advantage of greater flexibility in how you manage your time and finances. When choosing investments, consider those that align with your remote work lifestyle. For example, you may want to explore passive income opportunities, such as rental properties or dividend-paying stocks, that can provide a steady stream of income without requiring your constant attention. Additionally, you may want to prioritize tax-efficient investments to minimize your tax burden and maximize your after-tax returns. By aligning your investments with your remote work situation, you can build a financial strategy that complements and supports your unique professional circumstances.

Developing Key Financial Skills from Your Home Office

Despite the allure of working from home, achieving financial independence requires a certain level of discipline and skill. Fortunately, with the right approach, you can develop the necessary financial skills to secure your financial future. One crucial step is to educate yourself on the various aspects of personal finance. Understanding the fundamentals of budgeting, investing, and long-term financial planning will empower you to make informed decisions that align with your goal of achieving financial independence. To gain more insight into the steps you can take to become financially independent, check out this Steps You Can Take To Become Financially Independent blog post on Forbes.

Budgeting for the Self-Employed or Freelancer

When you work from home, you have the sole responsibility of managing your finances. This requires a proactive approach to budgeting, especially if you are self-employed or work as a freelancer. Unlike a traditional job with a steady paycheck, your income may fluctuate from month to month, making it essential to create a budget that accounts for variable income. By tracking your expenses, setting financial goals, and establishing an emergency fund, you can navigate the uncertainty of self-employment and maintain a healthy financial foundation.

Financial Planning for Long-Term Success

As you strive for financial independence from your home office, it’s important to prioritize long-term financial planning. This involves setting achievable financial goals, such as saving for retirement, investing in diversified assets, and regularly reviewing your financial situation. By creating a comprehensive financial plan, you can build a sustainable path to financial independence and mitigate the potential risks that may arise. Additionally, seeking professional advice from a financial advisor can provide valuable insights tailored to your specific circumstances, further enhancing your long-term financial success.

Optimizing Your Income Streams

Lastly, to achieve financial independence from your home office, it is crucial that you optimize your income streams. This means looking for ways to maximize your earnings in the most efficient and effective manner. By diversifying your income sources and implementing techniques for building a profitable work-from-home business, you can significantly increase your chances of reaching your financial goals.

Diversifying Your Income Sources

Diversifying your income sources is a key strategy for achieving financial independence. By spreading your income across multiple streams, you can reduce the risk of relying on a single source of income. This can include investing in stocks, real estate, or even starting a side hustle. By diversifying, you can protect yourself from potential downturns in any one industry or market. Remember, the more diverse your income, the more secure your financial future will be.

Techniques for Building a Profitable Work-from-Home Business

When it comes to building a profitable work-from-home business, it’s important to utilize techniques that can maximize your earning potential. This may involve leveraging online platforms, creating passive income streams, or building a scalable business model. Additionally, adopting a growth mindset and constantly seeking out new opportunities can help you stay ahead of the competition. Building a profitable work-from-home business requires dedication, hard work, and a strong understanding of your target market.

By optimizing your income streams, diversifying your sources of income, and implementing techniques for building a profitable work-from-home business, you can pave the way for financial independence from your home office. Remember, it’s not just about earning money, but also about managing and growing your wealth over the long term. How To Build Passive Income For Financial Independence is a great resource to explore for more in-depth guidance on this topic.

Remote Riches – Strategies for Achieving Financial Independence from Your Home Office

Following this guide, you now have a comprehensive understanding of the strategies and tools you need to achieve financial independence from your home office. By incorporating the principles of remote work, financial management, and entrepreneurship, you can create a successful and sustainable income stream from the comfort of your own home. Remember to stay disciplined, persistent, and adaptable as you navigate the challenges and opportunities of remote work. With dedication and the right mindset, you can build a prosperous and fulfilling career from your home office.

FAQ – Remote Riches: Strategies for Achieving Financial Independence from Your Home Office

Q: What is Remote Riches about?

A: Remote Riches is a comprehensive guide that provides strategies and tips for achieving financial independence from your home office. It covers a range of topics including remote work opportunities, financial planning, time management, and productivity tips for individuals looking to build a successful career while working from home.

Q: How can Remote Riches help me achieve financial independence?

A: Remote Riches offers practical advice and actionable steps to help you maximize your earning potential from your home office. It provides insights on identifying remote work opportunities, building a successful freelance career, managing finances, and making smart investments to achieve financial independence. The book also includes real-life success stories and case studies to inspire and motivate readers.

Q: Is Remote Riches suitable for beginners in remote work and entrepreneurship?

A: Yes, Remote Riches is suitable for beginners as well as experienced professionals. It is designed to provide guidance to individuals who are new to remote work and entrepreneurship, offering valuable insights and strategies for building a successful career from their home office. The book is written in a clear and accessible language, making it easy for readers to understand and implement the concepts outlined in the book.