Welcome, dear reader, to an illuminating discussion on the art of developing healthy financial habits that will lead you towards long-term wealth and riches. By immersing yourself in the workings of personal finance, you are embarking on a transformative journey that will empower you to take control of your financial destiny. However, bear in mind that this path does not unfold effortlessly; it demands discipline, sacrifices, and perseverance. In this blog post, we will delve into the essential steps you must take to succeed, as well as the perilous pitfalls you must avoid. With a resolute mindset, a sound plan, and unwavering commitment, you will navigate through the intricacies of personal finance, paving the way for a prosperous future. Proceed with caution, for the road ahead is fraught with financial dangers that can easily undermine your efforts towards wealth accumulation.

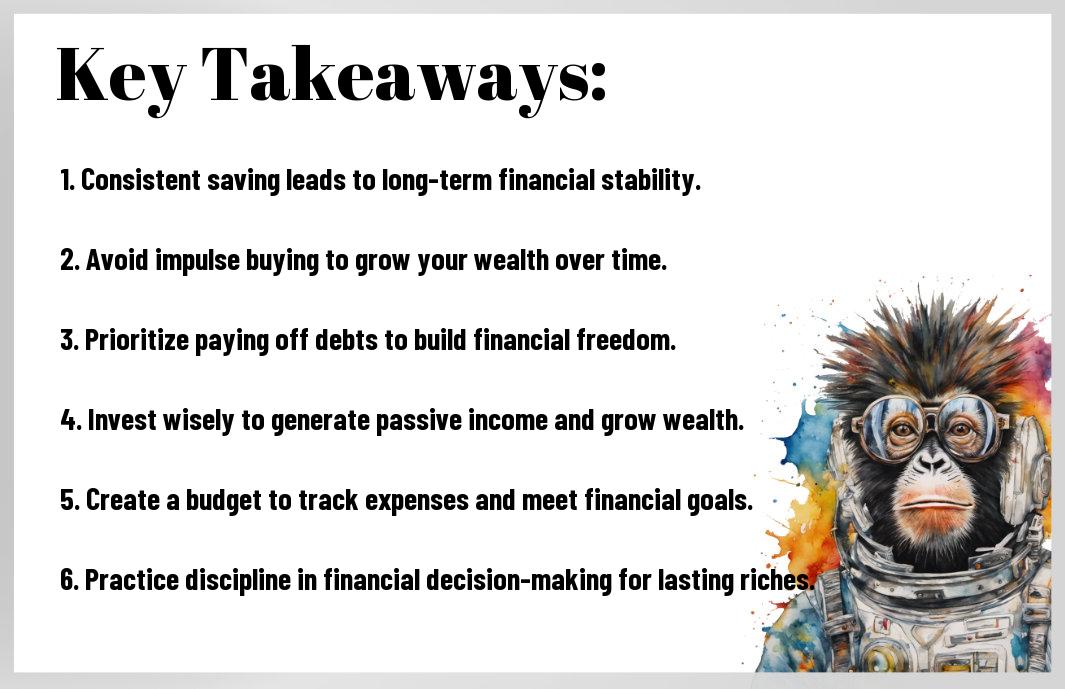

Key Takeaways:

- 1. Set clear financial goals: It is crucial to establish specific, measurable, attainable, relevant, and time-bound (SMART) goals to guide your financial decisions and actions.

- 2. Prioritize saving and investing: Cultivating the habit of saving a portion of your income and consistently investing it for the long term is imperative for building wealth over time.

- 3. Develop a budget: Creating and sticking to a budget helps you track your expenses, identify areas where you can cut back, and ensure you are consistently saving and investing towards your goals.

- 4. Diversify your investments: Spreading your investments across different asset classes and sectors helps mitigate risk and increase the potential for long-term growth.

- 5. Continuously educate yourself: Staying informed about personal finance, investment strategies, and new opportunities allows you to make informed decisions and adapt to changes in the financial landscape.

The Foundation of a Robust Financial Lifestyle

Now that you have decided to embark on a journey towards long-term wealth and riches, it’s crucial to establish a solid foundation for your financial lifestyle. This foundation will serve as the building blocks upon which you can develop healthy financial habits that will propel you towards your goals. In this chapter, we will explore two fundamental aspects that form the bedrock of a robust financial lifestyle: understanding your financial status and achieving financial literacy.

Understanding Your Financial Status

Before you can begin making meaningful progress towards your financial goals, it’s essential to have a clear understanding of your current financial status. This involves taking a comprehensive look at your income, expenses, assets, and liabilities. By having a firm grasp of these aspects, you can make well-informed decisions about your financial future.

Identifying your income sources is the first step towards understanding your financial status. This includes not only your regular job but also any additional sources of income such as investments, rental properties, or freelance work. Knowing how much money is coming in each month allows you to create a realistic budget and plan for the future.

Equally important is understanding your expenses. Tracking your spending habits and categorizing them can provide valuable insights into areas where you may be overspending and potential areas for saving. By scrutinizing and adjusting your expenses, you can gain control over your financial situation, allowing you to allocate more funds towards saving and investments.

Financial Literacy: A Key to Wealth and Riches

Financial literacy is a critical skillset that empowers you to make informed decisions about your money. Unfortunately, it is a skillset that is often overlooked and undervalued. By developing a strong foundation in financial literacy, you can navigate the complex world of personal finance confidently.

One of the primary benefits of financial literacy is the ability to make informed decisions regarding investments and financial products. Understanding the risks and rewards associated with different investment options allows you to make choices that align with your long-term goals. This knowledge protects you from falling prey to misleading offers or fraudulent schemes, safeguarding your hard-earned money.

Moreover, financial literacy equips you with the knowledge to create and manage a budget effectively. By knowing how to prioritize expenses and save smartly, you can optimize your income and ensure a secure financial future. Additionally, being financially literate enables you to effectively manage credit, avoid excessive debts, and build a strong credit history that lays the groundwork for future financial success.

Taking the time to understand your financial status and investing in financial literacy are crucial steps towards building a solid foundation for your financial health. These two core components provide you with the knowledge and awareness needed to make wise financial decisions. By prioritizing these aspects and learning from them, you can set yourself on the path to long-term wealth and riches.

Essential Healthy Financial Habits for Long-term Wealth

One of the key factors determining your long-term financial success is the development of healthy financial habits. These habits act as a solid foundation for building wealth and achieving financial security. By consciously adopting these habits, you can take control of your finances and pave the way for a prosperous future.

Saving and Investing Regularly

When it comes to securing long-term wealth, saving and investing regularly holds immense importance. Saving a portion of your income on a regular basis allows you to build an emergency fund, which provides a safety net for unexpected expenses. It also helps you to accumulate funds for larger goals, such as buying a house or starting a business. However, simply saving money is not enough to generate wealth in the long run. Investing is equally crucial to make your savings grow over time. By investing wisely in stocks, bonds, or real estate, you can participate in the growth of the economy and benefit from compounding returns.

Avoiding Excessive Debt and Loans

Excessive debt and loans can be detrimental to your long-term financial well-being. While it may be tempting to rely on credit cards and loans to fulfill your desires or cover unexpected expenses, this habit can quickly spiral out of control. High interest rates on debts can eat into your income and make it difficult to accumulate wealth. Instead, strive to live within your means and only take on debts when absolutely necessary, such as for education or a mortgage. By avoiding excessive debt and loans, you can maintain financial stability and allocate more of your income towards wealth-building endeavors.

Budgeting and Expense Management

Creating and sticking to a budget is a fundamental habit for managing your finances effectively. A budget helps you track your income, expenses, and savings, ensuring that you are in control of where your money goes. It allows you to identify areas where you can make adjustments and cut unnecessary expenses, enabling you to save more. By mastering the skill of budgeting, you can have a clear picture of your financial health and make informed decisions that align with your long-term wealth goals.

Continuous Financial Education

In the ever-evolving world of finance, continuous learning is key to staying ahead. Educating yourself about personal finance, investing, and the economy enables you to make informed decisions and identify opportunities for wealth creation. Seek out books, online resources, podcasts, or even consider attending seminars or workshops to expand your financial knowledge. By continuously educating yourself in financial matters, you can make smarter financial choices and avoid costly mistakes that could hinder your long-term wealth accumulation.

Ensuring Continued Financial Growth

Now that you have established healthy financial habits, it is crucial to ensure the continued growth of your finances. Building wealth and achieving long-term financial success requires ongoing effort and attention. In this chapter, we will explore two key aspects that will help you maintain and propel your financial growth: developing a resilient financial plan and sustaining your financial habits.

Developing a Resilient Financial Plan

A resilient financial plan is the foundation on which your long-term wealth will be built. It provides a roadmap for your financial journey and helps you navigate through uncertainties and challenges that may arise.

To develop a resilient financial plan, you should start by setting clear and achievable financial goals. These goals will give you a sense of direction and purpose, keeping you motivated and focused on your long-term wealth-building efforts. Whether your goals revolve around purchasing a home, retiring comfortably, or starting a business, they should be specific, measurable, attainable, relevant, and time-bound (SMART).

Once you have set your goals, it is essential to create a budget that aligns with your objectives. Your budget should outline your income, expenses, and savings, allowing you to track your progress and make adjustments as needed. By closely monitoring your finances, you can identify areas where you may be overspending and find opportunities to save and invest.

Another important aspect of a resilient financial plan is diversification. It is crucial to spread your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds. Diversification helps to reduce risk and protect your wealth from market fluctuations. By investing in a variety of assets, you give yourself a greater chance of earning solid returns while minimizing the impact of any individual investment’s poor performance.

Sustaining your Financial Habits

Developing healthy financial habits is not a one-time endeavor; it requires consistent effort and discipline. To sustain your financial habits and ensure continued growth, it is important to stay committed to your long-term goals and make financial management a part of your everyday life.

One key aspect of sustaining your financial habits is to regularly review and revise your financial plan. As your circumstances change and new opportunities arise, it is crucial to reassess your goals and make any necessary adjustments. This flexibility will allow you to adapt to changing financial landscapes and ensure that your plan remains relevant and effective.

In addition, it is vital to stay informed about financial matters. Keep yourself updated on the latest trends, economic factors, and investment opportunities. This knowledge will empower you to make informed decisions and take advantage of potential wealth-building opportunities.

Finally, surround yourself with like-minded individuals who share your commitment to financial growth. Joining a financial support group or seeking advice from a financial advisor can provide valuable insights and support along your journey. These connections can offer a fresh perspective, motivate you to stay on track, and provide accountability to help you achieve your long-term financial goals.

By developing a resilient financial plan and sustaining your financial habits, you are positioning yourself for continued financial growth. Stay focused, stay disciplined, and remember that your financial success is within reach.

The Impacts of Neglecting your Financial Health

One of the biggest mistakes you can make is neglecting your financial health. While it may not seem like a pressing issue in the present moment, the long-term consequences can be devastating. By failing to prioritize your financial well-being, you risk missing out on opportunities and facing unnecessary hardships. It’s essential to understand the impacts that neglecting your financial health can have on your journey towards long-term wealth and riches.

Wealth: More than Just Money

When it comes to building wealth, it’s important to consider more than just the monetary aspect. True wealth encompasses various factors, including your overall well-being, peace of mind, and the ability to pursue your dreams. By neglecting your financial health, you limit your potential to achieve these broader aspects of wealth.

Financial stability can provide a sense of security and freedom in your life. It allows you to focus on personal growth, experience new opportunities, and invest in things that matter to you. However, if you fail to develop healthy financial habits, you risk falling into a constant cycle of stress, worry, and missed chances for growth.

The Consequences of Poor Financial Habits

Poor financial habits can have a significant impact on your overall financial well-being. They can prevent you from achieving your desired goals and aspirations, both in the short and long term. One of the most dangerous consequences of neglecting your financial health is the accumulation of debt.

Debt can quickly spiral out of control if not managed properly. High-interest rates, late payment fees, and the constant burden of owing money can severely restrict your ability to build wealth. It’s easy to fall into a cycle of living paycheck to paycheck, struggling to make ends meet, and having no room to save or invest for the future.

Furthermore, neglecting your financial health can lead to missed opportunities for growth and financial success. Lack of financial discipline can prevent you from taking advantage of profitable investments, hinder your ability to seize entrepreneurial ventures, or even limit your employment options. Over time, these missed opportunities can compound, causing a significant setback in your journey towards long-term wealth and riches.

Additionally, poor financial habits can strain your relationships and impact your overall well-being. Financial stress often leads to increased tension at home, affecting your relationships with loved ones. Moreover, the constant worry about money can take a toll on your mental and emotional health, affecting your overall quality of life.

By neglecting your financial health, you essentially limit yourself from reaching your full potential and enjoying the fruits of your hard work. However, the good news is that it’s never too late to turn things around. By developing healthy financial habits and prioritizing your financial well-being, you can regain control and pave the way towards long-term wealth and riches.

Developing Healthy Financial Habits for Long-Term Wealth and Riches

Now, you have learned the importance of developing healthy financial habits for long-term wealth and riches. By consistently saving a portion of your income, budgeting wisely, and investing wisely, you can create a solid foundation for your financial future. Remember to always prioritize your financial goals and make sound financial decisions based on your long-term vision. By making these habits a part of your routine, you are taking control of your financial destiny and paving the way for a prosperous future. Start implementing these habits today and see the positive impact they can have on your finances and overall well-being.

FAQ

Q: Why is developing healthy financial habits important for long-term wealth and riches?

A: Developing healthy financial habits is crucial for long-term wealth and riches because it lays the foundation for a secure and stable financial future. By cultivating disciplined habits, individuals can build their wealth gradually over time, leading to financial independence and a comfortable lifestyle. It enables individuals to save more, avoid debt, and make informed financial decisions, ensuring their financial well-being even during economic downturns.

Q: What are some key financial habits one should develop for long-term wealth and riches?

A: To secure long-term wealth and riches, there are several key financial habits individuals should develop:

1. Budgeting: Creating and sticking to a budget helps maintain control over expenses and ensures money is allocated wisely.

2. Saving and Investing: Setting aside a portion of income regularly for savings and long-term investments allows wealth to grow steadily over time.

3. Managing Debt: Minimizing debt by paying off high-interest debts, such as credit cards, and borrowing responsibly promotes financial stability.

4. Continuous Learning: Keeping oneself updated with financial knowledge and seeking professional advice enables better decision-making and maximizes financial growth.

Q: How can one develop and maintain healthy financial habits?

A: Developing and maintaining healthy financial habits requires consistent effort and dedication. Here are a few steps to follow:

1. Set Clear Financial Goals: Define short-term and long-term financial goals to provide direction and motivation.

2. Create a Budget: Track and categorize expenses, and ensure that income exceeds expenditure. Regularly review and adjust the budget as needed.

3. Automate Savings and Payments: Set up automatic transfers to savings accounts and bill payments to ensure regular contributions without fail.

4. Avoid Impulse Buying: Practice mindful spending by giving careful thought before making purchases, distinguishing between needs and wants.

5. Monitor Progress and Adjust: Regularly evaluate financial progress, identify areas for improvement, and adjust strategies accordingly.

6. Seek Knowledge: Stay informed about personal finance through books, podcasts, or seminars to make well-informed financial decisions.

7. Surround Yourself with Like-minded Individuals: Engaging with people who have similar financial goals can provide support, accountability, and motivation.